CASE 3: TECHNIC ENTERPRISES AND SONAR-SUN INC.

You are an investment analyst for Timken Brothers, a small brokerage firm. Recent developments in the medical equipment industry have caused a number of Timken's customers to inquire about two particular companies, Technic Enterprises and Sonar-Sun Incorporated. You have been asked to analyze the financial statements of these two companies and—on that basis only—rate them on a scale from 1 (very weak) to 10 (very strong) with respect to (1) solvency position, (2) earning power and persistence, and (3) earnings quality. In addition to the ratings, you have been asked to provide a memo stating why the ratings on these three dimensions do (or do not) differ between the two companies. The ratings and the memo will comprise part of a report that will be used by Timken's brokers to guide their buy/sell recommendations. The financial statements of Technic Enterprises and Sonar-Sun Inc. follow.

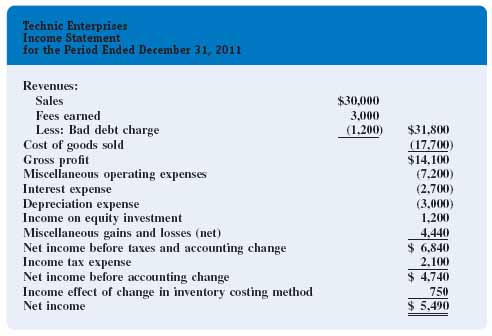

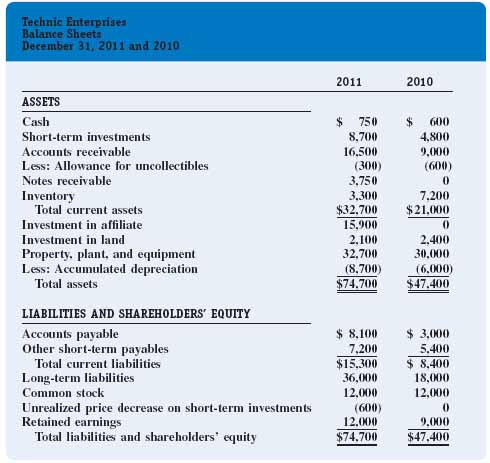

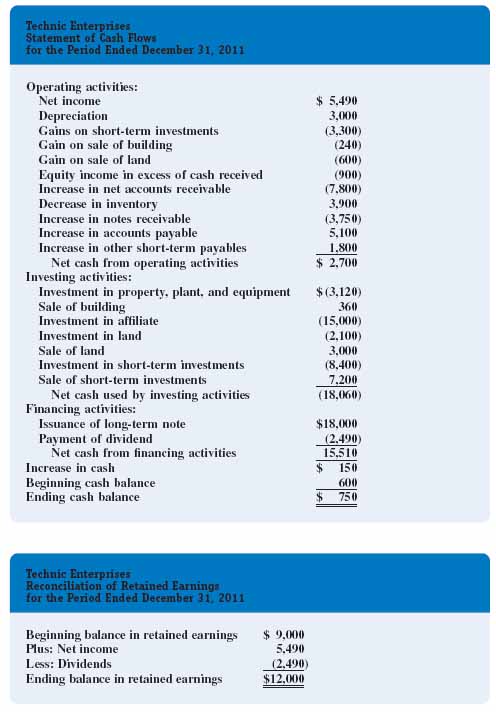

Technic Enterprises

The financial statements of Technic Enterprises and selected additional information are provided on the following pages. Dollar amounts are in thousands.

FOOTNOTES (DOLLARS IN THOUSANDS, EXCEPT PER-SHARE AMOUNTS) REVENUE RECOGNITION. ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.