THE INCOME STATEMENT

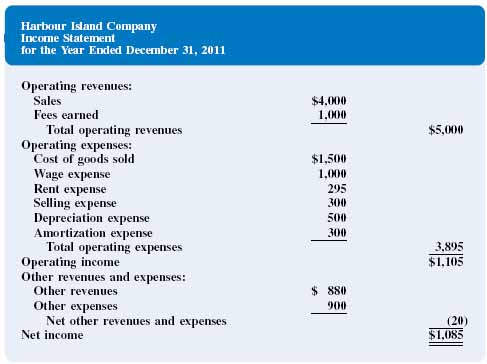

The income statement, sometimes called the statement of operations, measures operating performance over a particular period—the activities associated with the acquisition and sale of the company's inventories or services. An example, for the Harbour Island Company covering the year ended December 31, 2011, is illustrated in Figure 2-4. Note that it consists of three categories: operating revenues ($5,000), operating expenses ($3,895), and other revenues and expenses (–$20). The net amount of these three numbers yields a number called net income or loss, net earnings, or profits ($1,085). Net income is a very common and useful measure of operating performance. Most analysts, investors, creditors, and managers agree that net income is the most important number disclosed on the financial statements.

FIGURE 2-4 Income statement for Harbour Island Company

Operating Revenues

Operating revenues represent the inflow of assets (or decrease in liabilities) due to a company's operating activities over a period of time. Examples include sales and fees earned. The ability to generate operating revenues is often viewed as one of the important keys to success for a company.

Sales is perhaps the most common revenue account. It represents a measure of asset increases (usually in the form of cash or accounts receivable) due to selling a company's products or inventories. Operating ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.