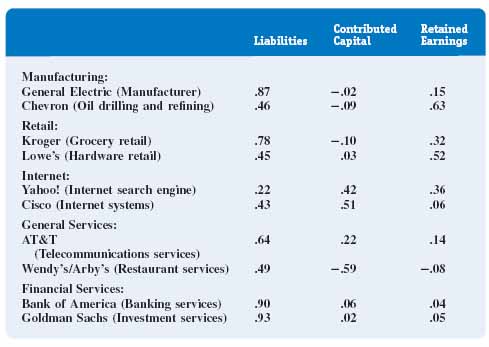

THE RELATIVE IMPORTANCE OF LIABILITIES, CONTRIBUTED CAPITAL, AND EARNED CAPITAL

Figure 12-2 illustrates the relative importance of the three forms of financing (liabilities, contributed capital, and retained earnings) for our selected firms. Overall, liabilities (with a few exceptions) are the primary financing source. Interest costs are tax deductib le, reducing the cost of borrowing, and as discussed before, leverage is a popular way to provide returns to shareholders without using their capital. Most Internet firms have not relied heavily on leverage for several reasons: (1) several years ago their stock prices were trading at huge premiums, which encouraged equity financing; (2) the speed of their growth created uncertainty associated with their future increased risks, discouraging debt capital providers; and (3) Internet firms had little collateral that could be used to secure loans. However, recently Cisco Systems has been issuing debt and repurchasing shares of its own stock. Its strong track record has opened up its borrowing ability.

FIGURE 12-2 The relative importance of liabilities, contributed capital, and retained earnings (percentage of total assets)

Note also that non-Internet firms rely very little on contributed capital; in fact, for GE, Chevron, and Kroger, the percent under contributed capital is negative. These companies are well-established, successful firms ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.