DETERMINABLE CURRENT LIABILITIES

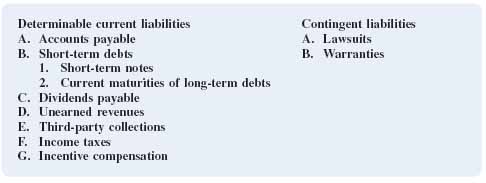

Determining the dollar amounts of all current liabilities, because they represent probable future outlays, involves an element of uncertainty. The relative degree of uncertainty gives rise to two current liability categories: (1) determinable and (2) contingent. Determining the dollar amount of a determinable current liability is relatively straightforward; determining the dollar amount of a contingent liability involves an estimate. Figure 10-3 provides an outline of the current liabilities covered in the next two sections.

FIGURE 10-3 Outline of current liabilities

In general, determinable current liabilities can be precisely measured, and the amount of cash needed to satisfy the obligation and the date of payment are reasonably certain. Determinable current liabilities include accounts payable, short-term debts, dividends payable, unearned revenues, third-party collections, and accrued liabilities.

Accounts Payable

Accounts payable are dollar amounts owed to others for goods, supplies, and services purchased on open account.2 They arise from frequent transactions that are normally not subject to specific, formal contracts between a company and its suppliers. These extensions of credit are the practical result of a time lag between the receipt of a good, supply, or service and the corresponding payment. The time period is usually short (e.g., thirty ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.