PROBLEMS

P8-1

Applying the mark-to-market rule to investments in equity securities

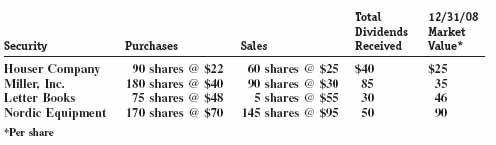

O'Leary Enterprises began investing in short-term equity securities in 2011. The following information was extracted from its 2011 internal financial records. Houser and Miller were classified as trading securities, while Letter and Nordic were classified as available-for-sale securities.

REQUIRED:

a. Compute the effect on reported 2011 income from all investment transactions and price changes.

b. Compute the effect on reported 2011 income if O'Leary Enterprises exercised the fair market value option for all its investments.

P8-2

Trading securities: Purchases, sales, dividends, and end-of-period adjustments

Anderson Cabinets began operations during 2005. During the initial years of operations, the company invested primarily in fixed assets to promote growth. During 2011, H. Hurst, the company president, decided that the company was sufficiently stable that it could now invest in short-term marketable securities, classified as trading securities. During 2011, the company entered into the following transactions concerning marketable securities:

| 1. March 10 | Purchased 1,000 shares of Arctic Oil & Gas for $28 per share. |

| 2. March 31 | Purchased 800 shares of Humphries Manufacturing for $10 per share. |

| 3. May 26 | Received a cash dividend of $1.25 per share from Arctic Oil & Gas. |

| 4. July 10 | Purchased ... |

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.