EXERCISES

E8-1

Accounting for short-term equity securities

Monroe Auto Supplies engaged in several transactions involving short-term equity securities during 2011, shown in the following list. The company had never invested in equity securities prior to 2011. All securities were classified as trading securities.

- Purchased 1,000 shares of IBM for $50 per share.

- Purchased 500 shares of General Motors for $80 per share.

- Sold 750 shares of IBM for $60 per share.

- Received a dividend of $1.50 per share from General Motors. Assume that the dividend was declared in a previous period.

- Purchased 200 shares of Xerox for $40 per share.

- Sold the remaining 250 shares of IBM for $30 per share.

- Sold the 200 shares of Xerox for $58 per share.

- Sold the 500 shares of General Motors for $60 per share.

a. Prepare journal entries for each transaction.

b. What effect did these transactions have on the company's 2011 net income?

E8-2

Mark-to-market accounting

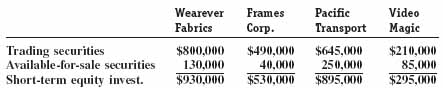

The following information was extracted from the December 31, 2011, current asset section of the balance sheets of four different companies:

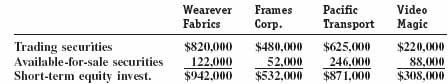

There were no transactions in short-term equity securities during 2012, and as of December 31, 2012, the controllers of each company collected the following information:

a. Compute the change in the wealth levels ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.