December 2018

Beginner to intermediate

684 pages

21h 9m

English

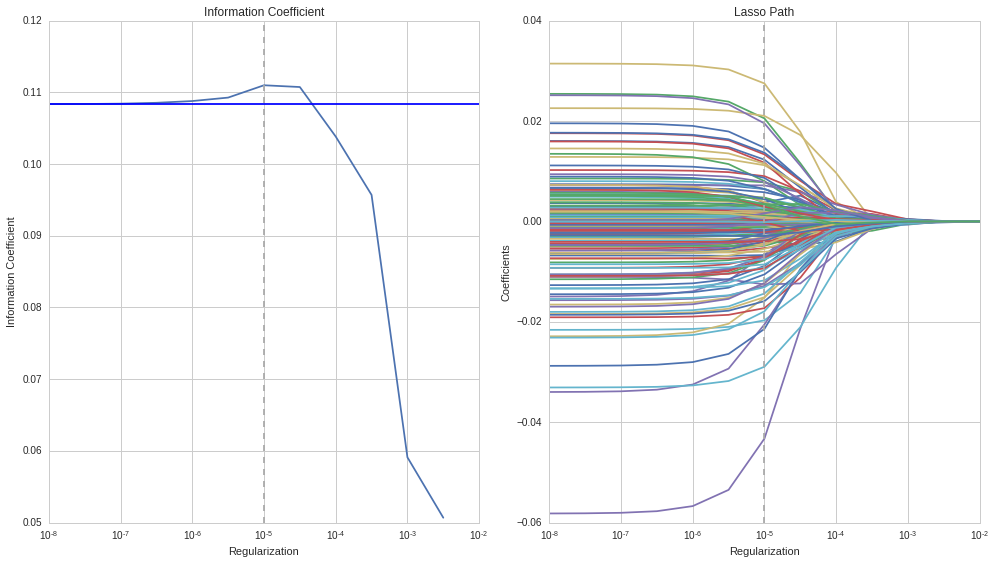

As before, we can plot the average information coefficient for all test sets used during cross-validation. We see again that regularization improves the IC over the unconstrained model, delivering the best out-of-sample result at a level of λ=10-5. The optimal regularization value is quite different from ridge regression because the penalty consists of the sum of the absolute, not the squared values of the relatively small coefficient values. We can also see that for this regularization level, the coefficients have been similarly shrunk, as in the ridge regression case: