December 2018

Beginner to intermediate

684 pages

21h 9m

English

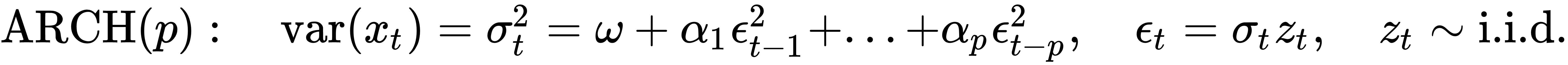

The ARCH(p) model is simply an AR(p) model applied to the variance of the residuals of a time series model that makes this variance at time t conditional on lagged observations of the variance. More specifically, the error terms, εt, are residuals of a linear model, such as ARIMA, on the original time series and are split into a time-dependent standard deviation, σt, and a disturbance, zt, as follows:

An ARCH(p) model can be estimated using OLS. Engle proposed a method to identify the appropriate ARCH order using the Lagrange multiplier test that corresponds to the F-test of the ...